- Opening : Mon-Fri 09:00 - 05:00

- Australian Business Number (ABN) # 64 666 659 758

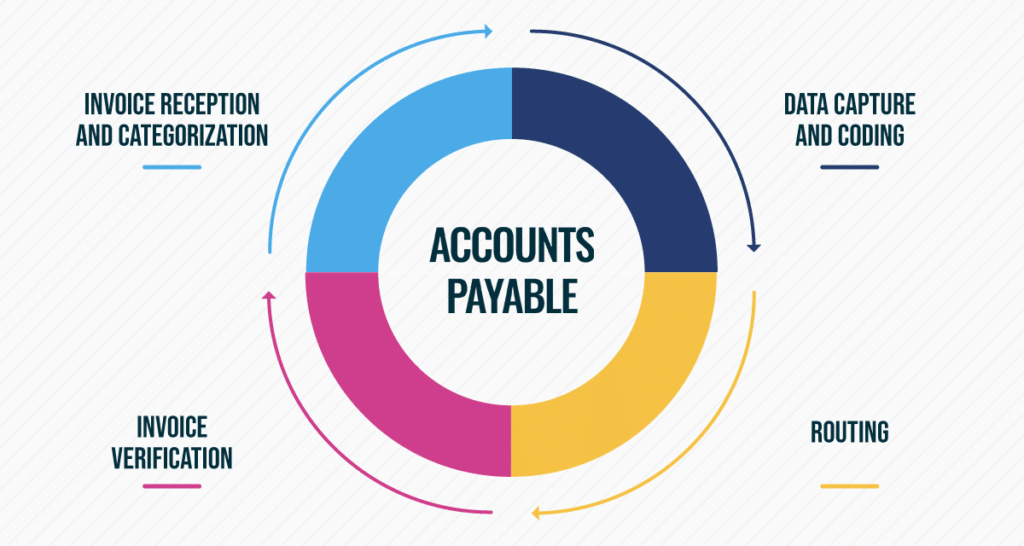

Accounts Payable

- Home

- Accounts Payable

Accounts Payable

Streamline your payments with our Accounts Payable expertise.

Accounts Payable (AP) is a fundamental component of a company’s financial accounting, representing the outstanding obligations and liabilities it owes to suppliers and vendors for goods and services received on credit. This process involves the tracking, recording, and management of these financial obligations until they are settled.

Upon receiving goods or services, a business creates an accounts payable entry to record the amount owed and the terms of payment. This entry includes details such as the supplier’s name, invoice number, date of the transaction, and the amount owed. The accounts payable ledger serves as a central repository for these entries, allowing for systematic tracking and organization.

Efficient accounts payable management is essential for several reasons:

Timely Payments: Keeping track of payment due dates ensures that a company can fulfill its financial obligations on time, maintaining positive relationships with suppliers and avoiding late payment penalties.

Cash Flow Management: Monitoring accounts payable helps businesses manage their cash flow effectively. By understanding upcoming payment obligations, companies can plan their finances and allocate funds strategically.

Accurate Financial Reporting: Proper accounts payable management contributes to accurate financial reporting. The accounts payable ledger is a crucial component in the preparation of financial statements, providing a comprehensive view of a company’s short-term liabilities.

Budgeting and Forecasting: Visibility into accounts payable allows businesses to forecast and budget more effectively. By understanding upcoming expenses, companies can plan for future cash outflows and make informed financial decisions.

Supplier Relationships: Maintaining a positive relationship with suppliers is vital for securing favorable terms and discounts. Timely payments and transparent communication contribute to building trust and long-term partnerships.

Compliance: Effective accounts payable management ensures compliance with contractual payment terms and agreements. This is crucial for avoiding legal issues and disputes with suppliers.

Audit Preparedness: Well-managed accounts payable records simplify the audit process. Accessible and accurate documentation supports transparency and compliance during financial audits.

In summary, accounts payable is a critical aspect of financial management, influencing a company’s liquidity, financial stability, and relationships with external stakeholders. Adopting efficient processes and leveraging technology for accounts payable management enhances overall operational efficiency and financial well-being.